Exploring a Central Bank Digital Currency for Vanuatu

As global trends in digital finance continue to evolve, Vanuatu must consider its position and potential in this space. While private platforms like MVatu and Digicel MyCash have introduced mobile wallets to the local market, they remain proprietary solutions operated by telecom companies.

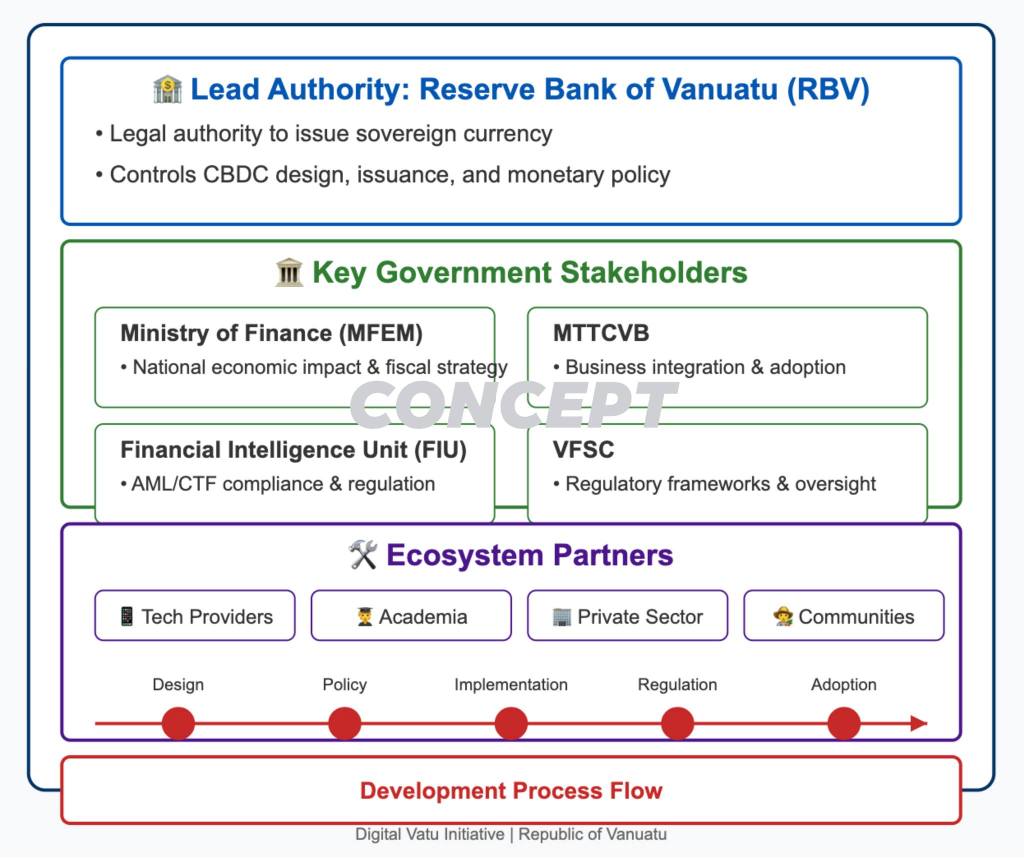

This concept proposes the Digital Vatu (VUVD) — a Central Bank Digital Currency (CBDC) issued and regulated by the Reserve Bank of Vanuatu. Unlike commercial platforms, a CBDC would be fully sovereign and tied directly to national monetary policy and regulatory oversight.

Why VUVD?

The introduction of a Digital Vatu could play a vital role in strengthening Vanuatu’s digital economy and ensuring long-term financial sovereignty. It also addresses several development challenges.

1. Financial Inclusion

- Remote Access: Individuals on outer islands could access financial services with a mobile phone, even without a traditional bank account.

- Unbanked Populations: A CBDC can bridge the gap for those currently excluded from the formal financial system.

2. Faster, Low-Cost Transactions

- Efficiency Gains: Domestic payments, public transfers (e.g. school subsidies, disaster relief), and remittances can be processed instantly.

- Lower Costs: Reducing reliance on cash and intermediaries could decrease transaction fees.

3. Security and Transparency

- Reduced Counterfeiting: Digital currency is harder to counterfeit than physical cash.

- Traceability: Transactions can be designed to be traceable (with privacy controls), aiding anti-fraud, KYC, and AML efforts.

4. Operational Resilience

- Disaster Response: During cyclones or ATM outages, a mobile-based CBDC could remain functional via digital networks.

- Reduced Cash Dependency: Supports continuity of essential services when physical infrastructure fails.

5. Digital Sovereignty

- Protecting the Vatu: A national digital currency ensures the Vatu maintains its relevance in digital commerce, reducing reliance on foreign stablecoins like USDT, USDC, or eAUD.

- Policy Control: Monetary policy tools can be extended to digital payments, ensuring local economic stability.

How VUVD Differs from Existing Platforms

| Feature | MVatu / MyCash | VUVD |

|---|---|---|

| Issuer | Private Companies | Reserve Bank of Vanuatu |

| Currency Type | Mobile Wallet | Legal Tender (CBDC) |

| Regulatory Control | Limited | Full Regulatory Oversight |

| Integration with National Policy | No | Yes |

| Sovereignty | External Systems | Local Infrastructure |

Strategic Direction

A well-researched pilot phase, guided by the Reserve Bank in partnership with stakeholders, can assess feasibility. VUVD should be designed with the following in mind:

- Mobile-first accessibility

- Offline functionality in remote areas

- Cross-border compatibility (e.g., AUD-VUVD)

- Compliance with international digital finance standards

Just a Thought for the Future

To be clear — I’m not putting this idea forward as an official proposal. I’m just opening up a conversation about where Vanuatu could go next in the digital finance space.

As we watch other countries explore central bank digital currencies, it’s worth asking: what would it look like if we had our own — a Vanuatu Digital Vatu (VUVD)? What could that mean for our people in remote islands, for disaster recovery, or even for protecting our currency in the online world?

It’s not about replacing what we have — like MVatu or MyCash — but thinking ahead, on our terms, about digital tools that are locally led and nationally trusted.

Just something to think about.

— Mattdotvu

Leave a comment