So there I was, sipping my morning coffee, feeling all good about being a responsible adult. I log into my local bank account, expecting to see my hard-earned savings sitting there nicely. But wait—what’s this? A few hundred vatu gone. Deductions. Again.

I scroll down and see that familiar phrase: “Service Fee.” Service for what exactly? Breathing? Keeping my money warm in their system? Honestly, it felt like I was being charged rent just for storing my own money. Like, come on, I didn’t ask for a monthly subscription to my own savings.

That was my final straw. That little deduction? It was the slap in the face that made me say, “enough’s enough.”

Maybe It’s Time We Go Digital?

I started digging around, asking myself, “What if we had our own digital currency? Something like a Digital Vatu (VUVD)—where we take back control, cut out the middlemen, and keep our wallets from bleeding every month.”

I’d written about it before, just to toss ideas around, but now? Now it’s real. It’s not just a theory anymore—it’s a solution knocking at the door, and Vanuatu better answer.

DeFi Ain’t Just for Crypto Bros

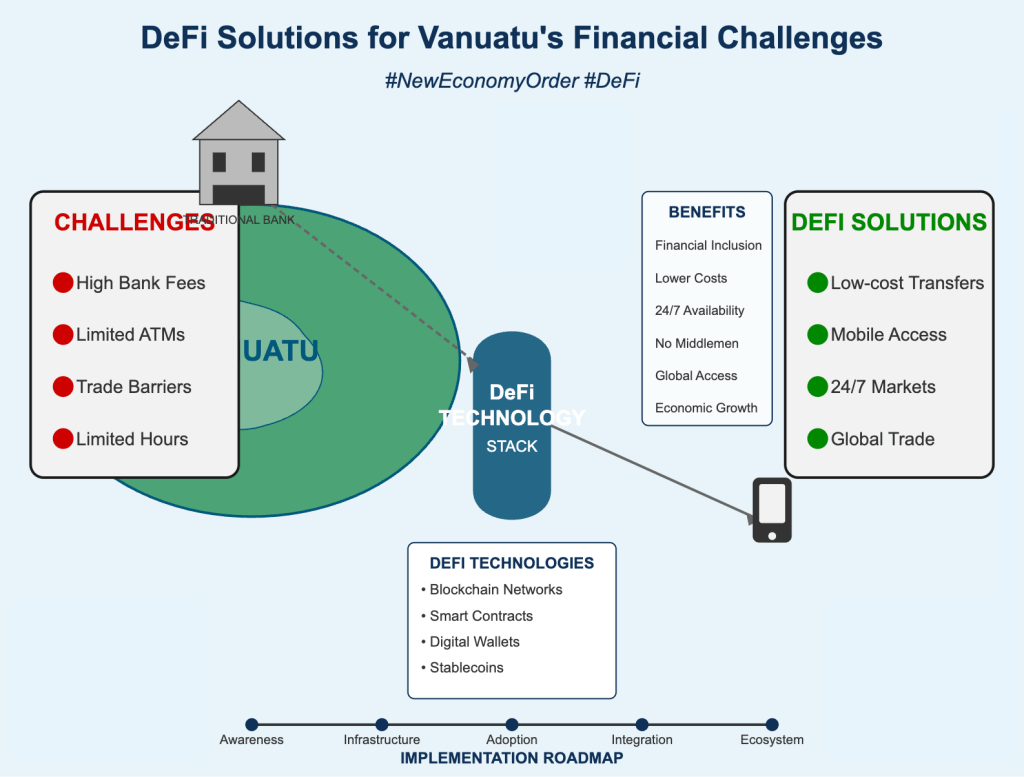

DeFi (short for Decentralized Finance) might sound like some complicated wizardry from Silicon Valley, but honestly, it’s simpler than people think. No banks. No long lines. No “we’re closed on weekends.” Just financial tools that run 24/7, with no suits behind a desk telling you what you can and can’t do with your own money.

In a place like Vanuatu, where ATMs are few and far between, and bank fees feel like daylight robbery, DeFi could be the equalizer. You’ve got a smartphone? You’ve got a wallet. You’ve got data? You’ve got access. No need to wait for a bank branch to open or deal with surprise fees that nibble away your savings like rats in the pantry.

Imagine a Digital Vatu (VUVD)

Imagine this: you receive your salary in VUVD. You send remittances to your family on the outer islands with zero transaction fees. You earn interest from staking—not 0.01% like banks give you, but actual, meaningful returns. Businesses get instant payments without the red tape, and kids grow up learning digital finance instead of how to fill in paper forms.

It’s not just about going digital. It’s about taking financial power back into the hands of the people. It’s about making money work for us, instead of the other way around.

Is Vanuatu Ready?

Honestly? Why not. We’ve got the brains, the drive, and the need. The current system is like a leaky canoe—we keep bailing out water (aka “service fees”), hoping we’ll stay afloat. But what we really need is to build a better boat.

DeFi and a Digital Vatu could be that boat.

Final Thoughts

So yeah, what started as me being pissed off over a few missing vatu turned into a deeper realization: we need change. Not just for the tech-savvy or the city dwellers, but for everyone—from mama selling laplap at the market to youths trying to hustle online.

The world’s moving forward. It’s high time Vanuatu jumps in the canoe, paddles hard, and rides the DeFi wave. Because right now? We’re still stuck paying “service fees” just for trying to save.

And that, my friend, ain’t it.

Leave a comment