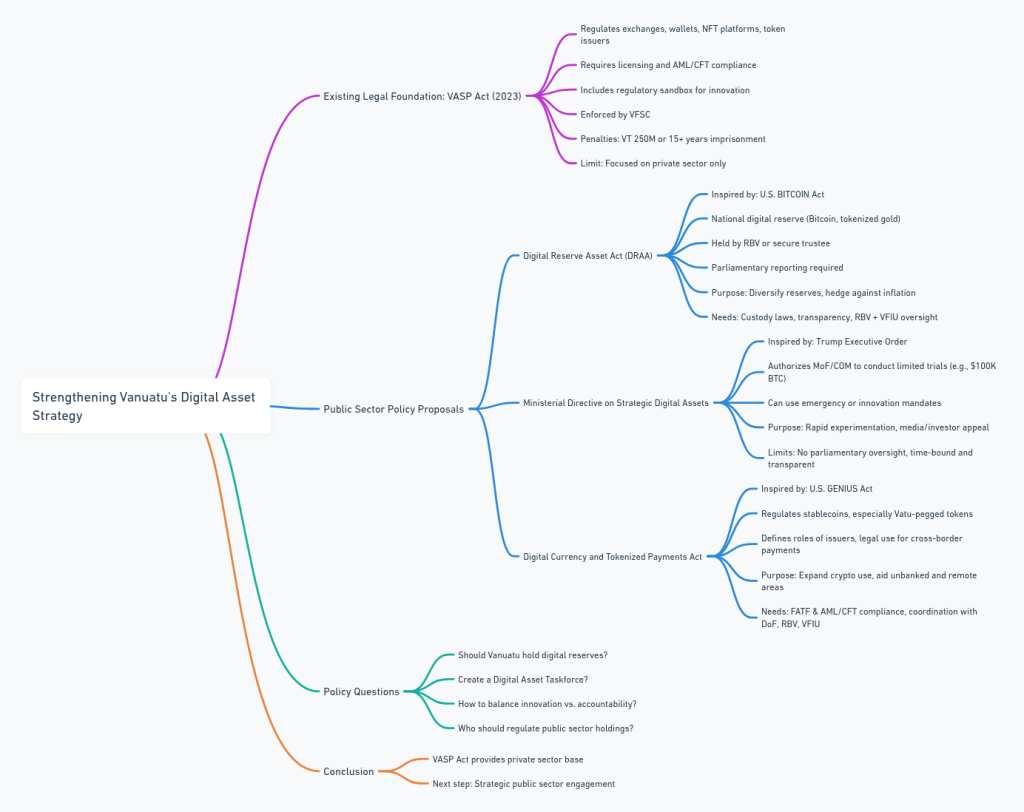

As major economies formalize digital asset strategies—such as the United States’ BITCOIN Act, Trump’s Executive Order, and the GENIUS Act—Vanuatu must consider its own path forward. But unlike many developing nations, Vanuatu already has a legal foundation in place.

This blog explores how we can build on our existing Virtual Asset Service Provider (VASP) Act, by introducing complementary public sector policies such as a national Bitcoin reserve, a Ministerial directive for trials, and a stablecoin legal framework.

EXISTING LEGAL FOUNDATION: VANUATU’S VASP ACT

In 2023, Vanuatu enacted the Virtual Asset Service Provider (VASP) Act, a modern legal framework that regulates digital asset service providers operating in or from Vanuatu.

The Act:

- Defines and regulates crypto exchanges, wallets, NFT platforms, token issuers, and custodians.

- Requires licensing, AML/CFT compliance, and includes a regulatory sandbox for innovation.

- Is enforced by the Vanuatu Financial Services Commission (VFSC), with penalties of up to VT 250 million or 15+ years imprisonment for breaches.

This law has already made Vanuatu a leader in digital asset regulation in the Pacific. But while the VASP Act focuses on private sector activity, there is currently no legal mechanism for public institutions—like the Reserve Bank or Ministry of Finance—to hold or test digital assets.

PROPOSALS TO COMPLEMENT THE VASP ACT

Here’s how Vanuatu could adapt global policy models to fill this gap and establish sovereign-level tools:

1. DIGITAL RESERVE ASSET ACT (DRAA)

Inspired by: U.S. BITCOIN Act

- Establish a national reserve of digital assets, starting with small allocations of Bitcoin or tokenized gold.

- Held by the Reserve Bank of Vanuatu or a secure trustee, with mandatory reporting to Parliament.

- Serves to diversify foreign reserves, reduce reliance on AUD/USD, and hedge against inflation.

Why?

- Strengthens sovereign financial resilience.

- Positions Vanuatu as a forward-thinking economic player.

What’s Needed:

- Clear laws for storage, custody, transparency.

- Oversight under RBV with coordination from the VFIU.

2. MINISTERIAL DIRECTIVE ON STRATEGIC DIGITAL ASSETS

Inspired by: Trump Executive Order

- Allows the Minister of Finance or Council of Ministers to initiate a limited digital asset trial, e.g. acquiring up to $100,000 in BTC.

- Could be issued under financial innovation or emergency powers, subject to reporting.

Why?

- Enables quick experimentation without needing full legislation immediately.

- Attracts investor attention and global media interest.

Limitations:

- Would lack parliamentary oversight unless later formalized.

- Should be time-bound (e.g. 12 months) and transparent.

3. DIGITAL CURRENCY AND TOKENIZED PAYMENTS ACT

Inspired by: U.S. GENIUS Act

- Creates a dedicated law for stablecoins, especially Vatu-pegged digital tokens.

- Defines the legal status of stablecoins, obligations for issuers, and how tokens can be used for cross-border payments, especially in the Pacific region.

Why?

- Vanuatu has already accepted Bitcoin for citizenship—this is the next logical step.

- Encourages financial innovation, especially for remote and unbanked populations.

Key Considerations:

- Must comply with FATF, AML/CFT, and regional standards.

- Requires coordinated input from DoF, RBV, and VFIU.

QUESTIONS FOR POLICYMAKERS IN VANUATU

- Should Vanuatu experiment with a national Bitcoin or digital asset reserve?

- Can we establish a Digital Asset Taskforce to consult and lead the transition?

- How do we balance innovation and public accountability?

- Should the regulation of government-held assets be placed under RBV, or require new institutional oversight?

CONCLUSION

Vanuatu’s VASP Act has laid the groundwork. Now, it’s time to ask:

What role should our government play in the digital financial system?

By carefully extending policy into the public sector space, we can ensure that Vanuatu is not just regulating digital assets—but strategically benefiting from them.

This content is provided for public policy discussion purposes only. It does not constitute legal, financial, or investment advice. The proposals outlined are exploratory in nature and intended to encourage informed dialogue on Vanuatu’s digital asset strategy.

Leave a comment